Trademark Value-Due Diligence

Used for concepts involving the investigation of a company or person prior to the signing of a contract with some diligence in care.

In general it takes place prior to a purchase process where the potential buyer evaluates a company objective or its assets with a view to a takeover.

It is an audit of the Industrial and intellectual property portfolio.

Prepares a report so that, through a research procedure, analyze, interpret and diagnose, the legal situation of an undertaking in the field of IP, according to some purposes established.

Through the “due diligence”, “buyer” (assignee, licensee, bank, inverter) can manage the risk (“know what they are buying”) and have arguments of price negotiation.

In the case of the “seller” (assignor, licensor, owner), will use the “due diligence” to maximize the price and the likelihood of sale.

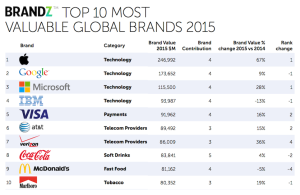

Top 10 most valuable brands